cumulative preferred stock adalah

The shareholders will receive the promised fixed amount whenever the dividends are declared. Cumulative preferred stock is a class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future.

It pays a fixed dividend amount and is more like a bond than a stock.

. Terdapat beberapa jenis preferen saham diantaranya adalah. While common stocks may respond to changes in interest rates a Preferred Stocks dividend rate will be fixed. Pemegangnya menerima dividen dan aset jika perusahaan dilikuidasi terlebih dahulu.

Advertisement Preferred stocks preferred shares atau saham preferen adalah skelas modal saham yang membayar dividen pada tingkat tertentu dan yang memiliki keistimewaan dibandingkan dengan saham biasa dalam hal pembayaran dividen dan likuidasi aset. In other words its a type of preferred stock that has a right to a specific amount of dividends each year. Cumulative preferred stock.

Jenis saham preferen satu ini dapat dikonversi menjadi saham biasa common stock. Sehingga Anda dapat menikmati keuntungan yang besar dan memudahkan untuk menjualnya. Saham Preferen preferred stock adalah surat berharga sebagai bukti kepemilikan atas suatu perusahaan dengan hak yang lebih tinggi atas aset dan laba perusahaan dibanding pemegang saham biasa.

It is a reliable source and is valued among investors. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. Such payments of dividends were guaranteed although not always paid out only when due.

Cumulative preferred stock refers to shares that have a provision stating that if any dividends have been missed in the past they must be. Saham preferen merupakan jenis saham yang biasanya membayar dividen tetap kepada investor. Saham Preferen Preferred Stock Saham preferen adalah suatu surat berharaga yang dijual oleh suatu perusahaan dengan menunjukan nilai nominal rupiah dolar yen dan sebagainya yang dapat memberi pengembangannya berupa pendapatan yang tetap dalam bentuk deviden yang akan diterima setiap kuartal tiga bulan.

Cumulative preferred stock is a class of stock that where undeclared dividends are allowed to accumulate until they are paid. All the past omitted dividends are accumulated and assured to be paid. Therefore the amount of these past omitted dividends that.

Preferred stocks such as cumulative preferred stocks often resemble bonds related to valuation. Cumulative preference shares include provisions which need the owner to pay all dividends to the shareholders even those that are omitted earlier and then give it to the common shareholders. This means that the company is supposed to pay all the dividends including the ones that were previously not paid out to these cumulative preferred shareholders.

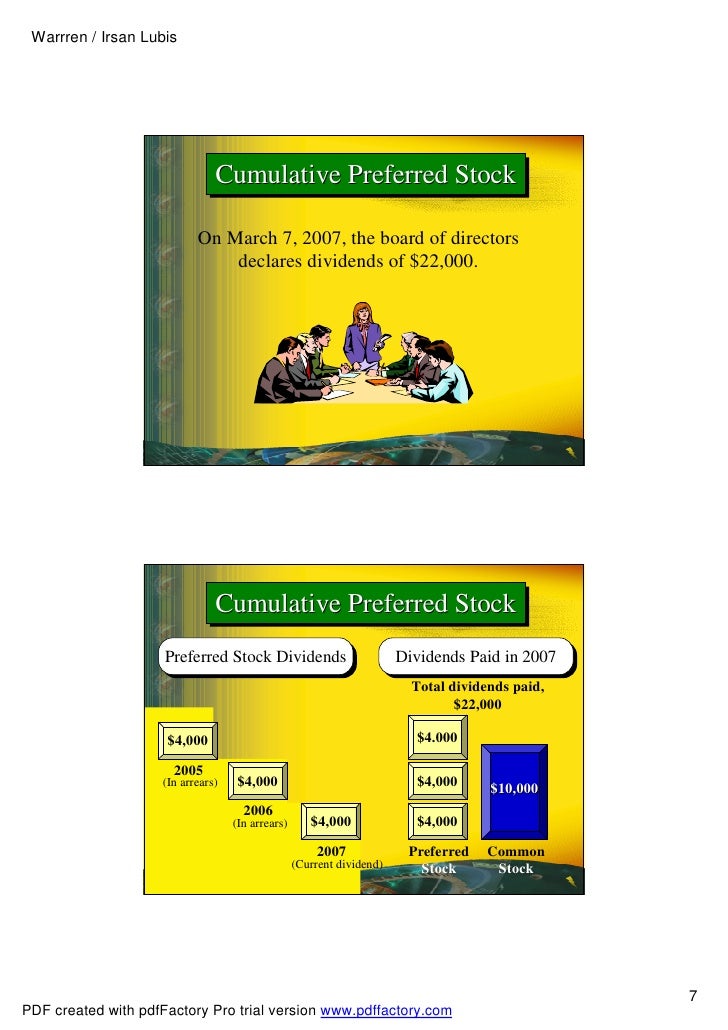

If any dividend payments have been missed in the past the dividends must be paid to cumulative preferred shareholders prior to any other shareholder. Cumulative preferred stock refers to shares that have a provision stating that if any dividends have been missed in the past they must be paid out to preferred shareholders first. The amount of cumulative dividends per preferred share is 125.

Dengan demikian semua keuntungan. What Is Cumulative Preferred Stock. Cumulative preferred Kalau tipe ini seperti pada.

This includes the current period dividend of. Aggregate favored stock is a kind of favored stock with an arrangement that specifies that assuming any profit installments have been missed previously the profits owed should be paid out to combined favored investors first. Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time after a predetermined.

Typically the corporations board of directors will not declare a dividend they will be omitting. Definition of Cumulative Preferred Stock. However such stocks are costlier do not have voting rights and cannot demand interim dividends.

Sayangnya setelah diganti menjadi saham bisa Anda tidak dapat mengubahnya menjadi preferred stock lagi. If the dividends arent declared or paid the stock can accumulate the unpaid dividends for a future date when they are declared. Cumulative preferred stock sometimes called cumulative dividend preferred shares is a type of preferred stock that provides assurance for dividend payments.

Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to cumulative preferred shareholders first before any other shareholders such as common shareholders. A Cumulative Preferred Stock is a type of financial product that is similar to a bond. Saham jenis ini memberikan hak kepada pemiliknya atas pembagian dividen yang sifatnya kumulatif dalam suatu persentase atau jumlah tertentu.

Suppose four dividend payments have been missed. Cumulative preferred stocks are entitled to receive all the missed unpaid dividends. Cumulative preferred stock is a type of preferred stock for which any omitted dividends must be paid before the corporation is allowed to pay a dividend on its shares of common stock.

Apa Itu Saham Preferen Definisi Dan Penjelasannya

Chapter 16 Earnings Per Share And Retained Earnings

Preferred Stock And Common Stock Dividend Allocations Youtube

Chapter 24 Corporate Stock And Earnings Issues 1

Cost Of Preferred Stock Rp Formula And Excel Calculator

Redeemable Preference Shares Examples Definition How It Works

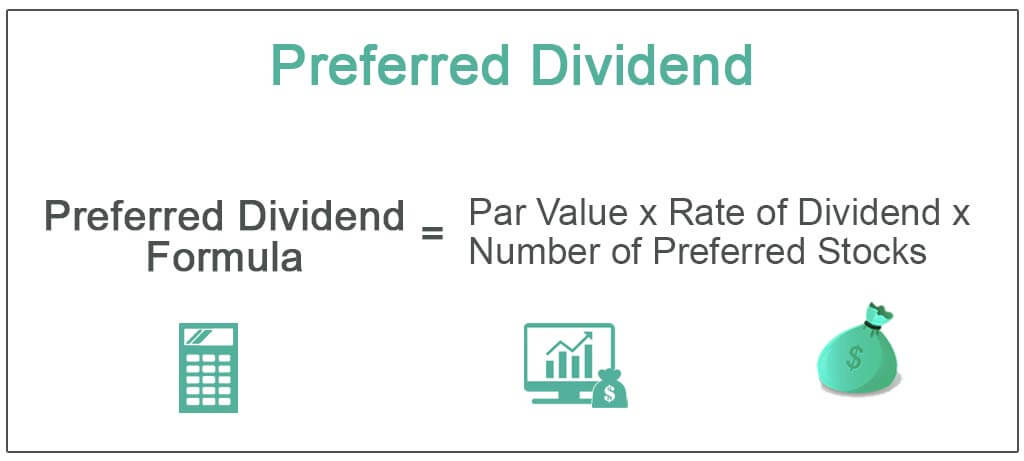

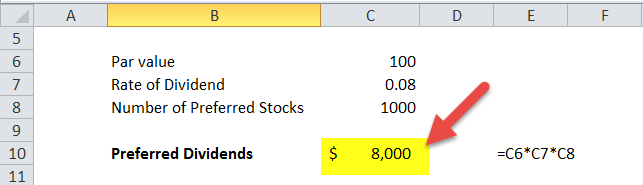

Preferred Dividend Definition Formula How To Calculate

Stockholders Equity Chapter 15 Intermediate Accounting 12 Th

Corporations Paidin Capital And The Balance Sheet Chapter

19 1 Chapter 19 Hybrid Financing Preferred Stock

Difference Between Cumulative And Non Cumulative Preferred Stocks Ask Any Difference

Common Stock Formula Calculator Examples With Excel Template

Preferred Dividend Definition Formula How To Calculate

Cost Of Preferred Stock Rp Formula And Excel Calculator

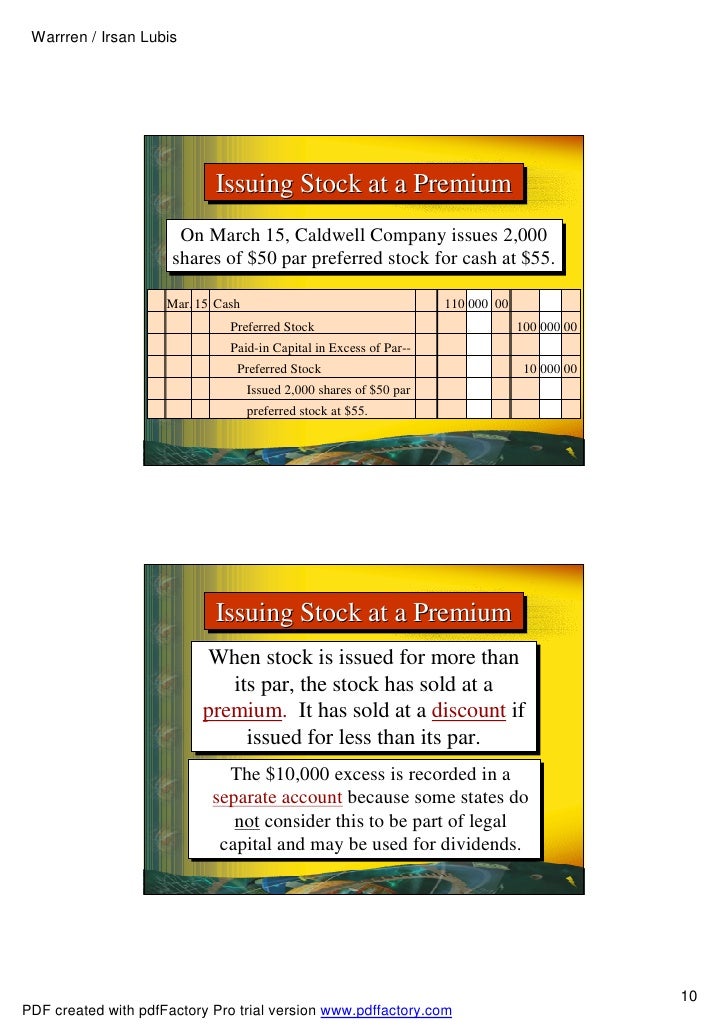

Financial Accounting Seventh Edition Ppt Download